The telecommunication industry may seem like a giant making easy money, too big to be bothered by their modern rivals. The traditional Telcos have approximately five billion customers worldwide, equating to 70% of the world population (Mogg, Dahlke, Wimmer, & Hoffmann, 2012).

However, when you look closely, you will realise that Telcos globally are constantly battling to stay competitive. The challenges Telcos face have evolved through the years, and the battle for survival is only becoming harder.

Telecommunication companies today are struggling to find their identity. They are at a crossroad, with one path leading them towards becoming a sheer backbone or a pipeline and another towards adapting and playing a pivotal role in digital transformations. For the latter, Telcos find themselves in a unique position of competitive advantage, since mobile technology is the core of the digital ecosystem. Telcos have the most direct access to the consumers who are the most reliant participants of the digital ecosystem. While they have access to the voice of the customers most of them are still struggling to have a place in their hearts.

On the other hand, who would have ever imagined that a non-Telco, like Google, would launch its own broadband services in the US! Or that a company like Twilio would open up the Telco services as Application Programming Interfaces (APIs) and piggy back on the network which is provided by the Telcos, eating into their revenues! Globally, the telecommunications industry is under pressure to rationalise players. OTT Players like Apple and Google are posing serious threats to Telcos, edging them into the abyss of customer ignorance. In an era where Mobile Wallet, Apple Pay and M-Pesa are posing threats to the BFSI Industry, and Netflix has disrupted the traditional CD/DVD industry, Communications Service Providers (CSPs) need to quickly identify the threats and act to build an ecosystem which enriches the customer experience and puts it at the heart of their digital evolution. Let’s try to find an answer as to whether the Telcos are really facing a lot of competition from unknown quarters by doing an industry analysis.

Porter’s Five Force Model (Porter, 1980)

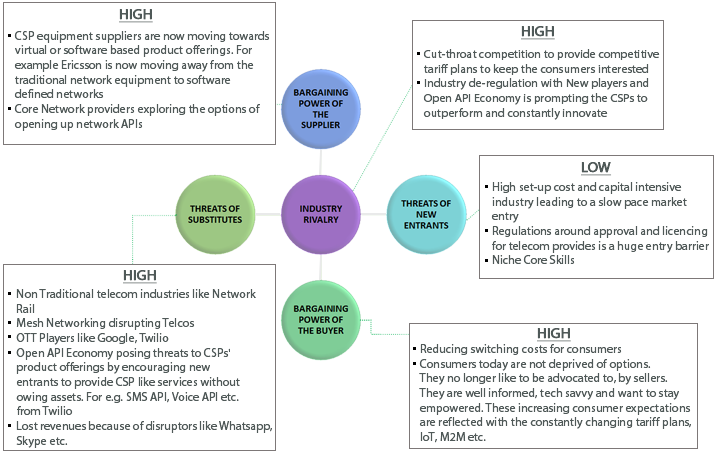

The analysis for the communications industry is done using “Porter’s Five Forces Model” (Porter, 1980). Figure 1 below illustrates Porter’s five forces.

Figure 1- Porter's Five Force Analysis

Threat of New Entrants - Low

- For any new entrant, the set-up costs are extremely high and the industry in general is capital intensive which slows down the pace of market entry. A lot of liquid cash is required for entering the communications industry. It needs a network infrastructure that costs millions of dollars if not more. According to US Telecom, in the last 20 years, Telcos in the US alone have invested approximately $1.1 Trillion in the industry

- The telecommunications industry is highly regulated and regulations around approval and licensing for establishing oneself as a CSP are a huge barrier to entry for new players

- The skills required to set up a new communications company are expensive and rare to find which makes it even more difficult for a new entrant

- The market is already extremely competitive with constant price wars between established players

Threat of Substitute - High

- Non-traditional telecommunication industries like railways and energy are putting in huge investments to set up their own communication line and are laying high speed networks, which all pose a huge challenge for CSPs. Companies like Network Rail and Reliance Geo are now also entering into the communications space

- Mesh Networking is an interesting concept, in which each node acts like a data relay center. John Straw states “Mesh networking will disrupt (will, not may) that last mile of internet delivery – and really threaten existing broadband and mobile carriers” (Straw, 2014)

- Open API Economy poses threats to CSPs’ product offerings by encouraging new entrants to provide CSP-like services without owning assets, for example, SMS API, Voice API etc. from Twilio

- Growing IP based services with lost revenues because of disruptors like Whatsapp, Skype, Facebook etc. In fact, research shows that “WhatsApp has shown How Phone Carriers Lost Out on $33 Billion revenue” (Kharif, Thomson, & Laya, 2014)

- Introduction of embedded SIMs will change the dynamics of the telecommunication industry. Both Apple and Samsung have been exploring options to do away with physical SIMs and move towards e-SIMs. “The e-SIM will effectively decouple the handsets (and the customers) from the network (and operator), and can change the dynamics in the industry.” (Anonymous, 2016)

- Over The Top (OTT) Players like Google, Twilio

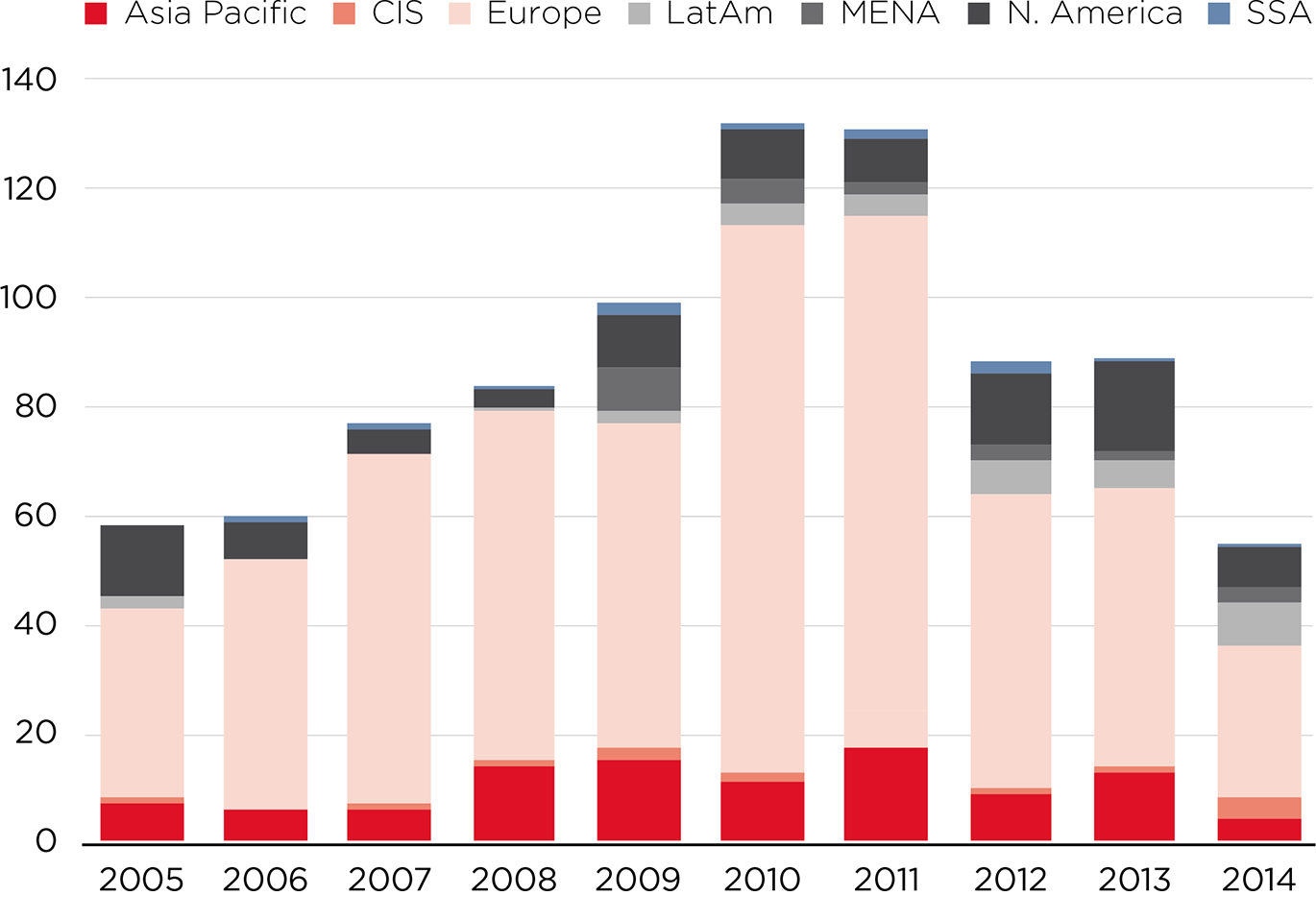

- To increase the competition in the industry, there has been a significant increase in the number of Mobile Virtual Network Operators (MVNOs) which can provide the same services that Telcos offer by using the network of an established communications company. Figure 2 below shows the number of MVNOs launched between 2005 and 2014

Figure 2- MVNO and sub-brand launches by region (Dewar, 2015)

Bargaining Power of the buyer - High

- Regulators are now inclined to reduce switching costs for consumers. In fact, Ofcom in the UK is already having conversations with the various CSPs on this. Once the switching costs are reduced, there would be no locking down of customers and customer loyalty would be a think of the past

- The consumers today are well informed and tech savvy. They are not deprived of options. They no longer like being told what the options are for them, but instead seek empowerment. These increasing consumer expectations are reflected with the constantly changing tariff plans, M2M, IoT and Telcos constantly looking at how they could be customer centric

- E-SIMs will reduce the dependencies on the communications providers enabling the consumers to switch providers which will eventually lead to a less fragmented market. (Bicheno, 2015)

Bargaining Power of the Supplier - High

- CSP equipment suppliers are now moving towards virtual or software based product offerings. For example, Ericsson is now moving away from the traditional network equipment to software defined networks (SDNs)

- Core Network providers are exploring the options of opening up network APIs

Industry Rivalry - High

- Cut-throat competition to provide competitive tariff plans which keep the consumers interested

- Industry de-regulation with new players and Open API Economy is prompting the CSPs to outperform and constantly innovate

- Legacy IT estates are making it exceedingly difficult for the CSPs to constantly innovate and stay competitive. A lot of CSPs are thereby engaging in huge IT Transformation programmes to harness the capabilities of leading edge technologies. But the million-dollar question is: Do these companies have the luxury of time to remain competitive?

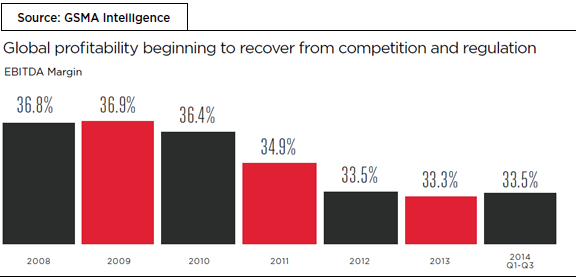

The above factors have led to declining operating margins in the telecommunications industry which can specifically be seen for mobile operators as in Figure 3. Further, due to the declining margins, the industry has seen a lot of mergers and acquisitions in the last 5 years to survive.

Figure 3- EBITDA Margins of Mobile Operators (GSMA, 2015)

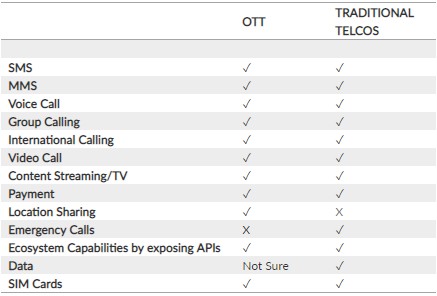

The table below shows the services offered by Traditional Telcos and now being offered by the OTT Players as well.

Table 1- OTT versus Traditional Telco Services (Srivastava, 2016)

Based on the above analysis, it is evident that the communication industry is facing fierce competition from the OTT Players and is possibly on the verge of disruption. Telcos pose a threat of becoming a network pipeline from four of the five forces, if they do not open their assets and expose their APIs. Companies like Uber and AirBnB have championed this area, as platform aggregators, and it would be easy for OTT Players like these to come in and disrupt the communications industry by providing substitute services similar to WhatsApp which disrupted Short Messaging Service, Skype which disrupted VoIP, or for that matter Twilio which has opened up almost all Telco services like SMS, MMS, VoIP, Call Recording, etc. as an API and is CSP agnostic for the consumer and is riding on the adoption of Cloud capabilities (Rogers B. , 2013).

Having said that, competition because of OTT Players/Platform aggregators becomes a threat only when it is not recognized. CSPs can use the new highways of commerce by enriching and exposing what they own. Brand names and value, established over years, should be leveraged, before they become extinct. The personalized experience that is now offered to customers can be best enriched by harnessing the power of the Internet of Things. Thankfully it’s still all about building a better mousetrap, curating and monetising a better customer experience and establishing new and indirect revenue channels moving away from traditional B2C model to B2B2C model. While we have established that there is a lot of competition from unknown corners, the big question is: Is API Economy really disrupting the Telcos’ digital businesses or is it a new lifeline? Are Telcos moving fast enough so that they do not become the Kodaks or Nokias of yesterday?

References

Anonymous. (2016, Jan).

Retrieved from http://telcohub.io/how-can-embedded-sim-disrupt-mobile-telecom-business/

Bicheno, S. (2015).

Apple and Samsung said to be close to e-SIM agreement. Retrieved from http://telecoms.com/432232/apple-and-samsung-said-to-be-close-to-e-sim-agreement/

Dewar, C. (2015). The global MVNO footprint: a changing environment. GSMA Intelligence. GSMA. (2015).

The Mobile Economy. London: GSMA Intelligence.

Kharif, O., Thomson, A., & Laya, P. (2014, February). Retrieved from

http://www.bloomberg.com/news/articles/2014-02-21/whatsapp-shows-how-phone-carriers-lost-out-on-33-billion

Mogg, A., Dahlke, A., Wimmer, P., & Hoffmann, C. (2012).

Telco 2020 – How Telcos transform for the "Smartphone Society". Roland Berger. Retrieved from https://www.rolandberger.com/media/pdf/Roland_Berger_Telco_2020_20120306.pdf

Porter, M. E. (1980).

Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: The Free Press.

Rogers, B. (2013). Jeff Lawson's Twilio Disrupts Telecom Industry. Retrieved from http://www.forbes.com/sites/brucerogers/2013/08/12/jeff-lawsons-twilio-disrupts-telecom-industry/#38fde6233dc6

Srivastava, R (Feb 2016), Will API Economy disrupt the Telecommunications Industry? DipSI Project (2015-16) Saïd Business School

Straw, J. (2014, December). Disrupted Telecoms – Mesh networking disrupts the “last mile”.

Retrieved from http://idisrupted.com/disrupted-seriously-telecoms-mesh-networking-disrupts-last-mile/

About the Author

Rishu Srivastava - Rishu works as a Business Unit Head at Torry Harris Business Solutions and handles the company’s key IT services accounts in the Telecommunications and Energy Management Sectors in the European region.

Rishu Srivastava - Rishu works as a Business Unit Head at Torry Harris Business Solutions and handles the company’s key IT services accounts in the Telecommunications and Energy Management Sectors in the European region.

Related Posts

GenAI creates new content, including images, and texts, by learning from training datasets. Its ability to simulate complex behaviors, generate novel and personalized content, adapt in real-time, and remain robust even in the face of data scarcity sets it apart from traditional AI and Machine Learning (ML) models.

Data analytics and customer research, personalization, multichannel presence, and intelligent outsourcing can make a world of a difference in the way you are perceived by your customers. When done well, this results in generating customer loyalty and translates to revenues.

Transformations aren’t easy, they don’t happen overnight and without governance and reporting measures, there is a strong possibility of failure to change and a loss of credibility for the teams involved.

Whitepaper

Analyst Speak

(THIS) has been cited among notable vendors by Forrester Research in its report ‘The API Management Software Landscape, Q1 2024’. The report recognizes Torry Harris as a provider offering API management solutions with a geographic focus in the EMEA & APAC regions.

Forrester observes that the initial rush to “lift and shift” to the cloud has now been replaced by a focus on modernization and digital transformation. Cloud migration is the first step in a long journey to take advantage of the latest cloud-native technologies and services.

Torry Harris is a 'Strong Performer' in The Q3 2022 Forrester Wave™ for API Management Solutions. This report shows how each provider measures up and helps technology architecture and delivery (TAD) professionals select the right one for their needs.

Past Webinars