Business Challenge

In many emerging markets, millions of people are constrained with limited access to cash machines and/or bank branches. Even if they did have access, the sheer effort required to access money and then to transfer it, is typically a tedious process. Mobile Money addresses this challenge quite remarkably, owing to which we see a consistent increase in both the transaction volumes and the revenues for the operators offering this service.

In order to ride on the success of this ‘mobile money transfer’ wave, THBS were asked to create “interoperability” of the Mobile Financial services offerings for a Telco major in an emerging market.

Business Benefits

Solution

The need of the hour was “interoperability” of ‘mobile financial services’ offerings for the Telco major client. Interoperability, especially in markets where no ‘one provider’ dominates, can drastically reduce costs for consumers, increase scale & outreach and contribute to a sustainable business model for mobile money. Examples of such interoperable models are:

- Person-to-person money transfers (P2P) i.e transfers via mobile between a customer of one mobile money provider to the customer of another mobile money provider and vice-versa

- Interoperability between Banks and Telcos to offer these kind of services and other financial services

- Agent rebalancing or transfers from one agent wallet to another agent wallet

Torry Harris enabled a large telecom operator in an emerging market to garner 46% market share through their Mobile Financial Services offerings, by API-enabling the carrier’s internal IT real-estate and building the transaction gateway for third party collaboration. Theirs was one of the first cross-carrier mobile money partnerships, allowing consumers to perform money transfers using different channels, including smartphone Apps.

The reusable solution we implemented, among other things, allows the telecom client to integrate with bill payment companies through a configurable payment gateway solution. We focused on the use of enterprise-class open source tools, designing excellent user-experiences and used an onsite-offshore model of delivery, for an impactful yet cost-efficient solution.

Improved Agility

As APIs from the back-end converge, customers expect a common user experience at the front-end. The client IT landscape needed to be agile to accommodate these requirements. The API architecture we designed and implemented helped rationalize legacy IT systems into reusable, general-purpose functionality blocks that facilitated quicker changes to business processes. As a result, the business was better supported to go-to-market with new products and services as well as in the introduction of new channels.

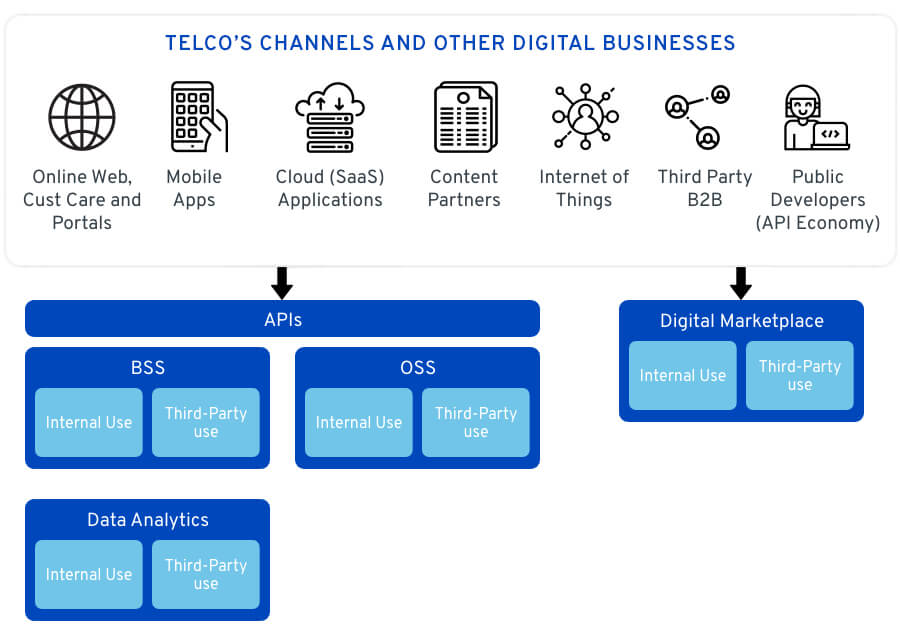

Digital enablement of a typical Telco for third-party collaborations